How to Protect Your Financial Investment with Thorough Credit Checks

Many landlords want to eliminate the agent and often opt to advertise and market the property themselves to omit paying the procurement (placement) commission. Some prefer to use an agent that will slash their commission to procure a ‘decent’ tenant.

I want to urge landlords to please use discernment and be wise when doing so. Do not be misled by the carrot dangling in front of you. 12 Months’ rent paid upfront can be tempting. This is the tactic that some prospective tenants will use to divert your focus off the warning flags. Do you know where the source of funds is coming from? Please research and do the necessary credit vetting on your applicant. There is a saying “clothes do not make the man” but doing things the proper way will sift the truth from the lies and certainly protect you and give you peace of mind.

What might seem fitting:

Why credit vett your tenant? What protection does it offer you?

TPN (Tenant Profile Network), is a registered credit bureau specializing in property rentals. TPN offers various credit reports to agents and landlords ranging from the basic to comprehensive reports. MRC Moldenhauer Property Management subscribes to TPN and by uploading bulk data on a monthly basis we can provide you the landlord with this premium RentCheck report. TPN extracts and scores data from 3 different credit bureaus and measures the affordability of the applicant and provides you the landlord with a comprehensive colour report outlining:

· Lists the active and inactive accounts

· Records Defaults, Judgements and Civil Records

· Financial Institutions where bank accounts are held

· Credit Cards and payment history

· Personal Loans and Micro Loans

· Active Summary on open accounts, closed accounts and the balance owning

· Indicates if the consumer is under debt-review

· Vehicle Financing

· School payments

· Bond account

· Employers

· Enquiries done

· Director – Registered or Deregistered or resigned

· 10 most recent physical addresses

· Leases entered and the payment history

What does all this mean?

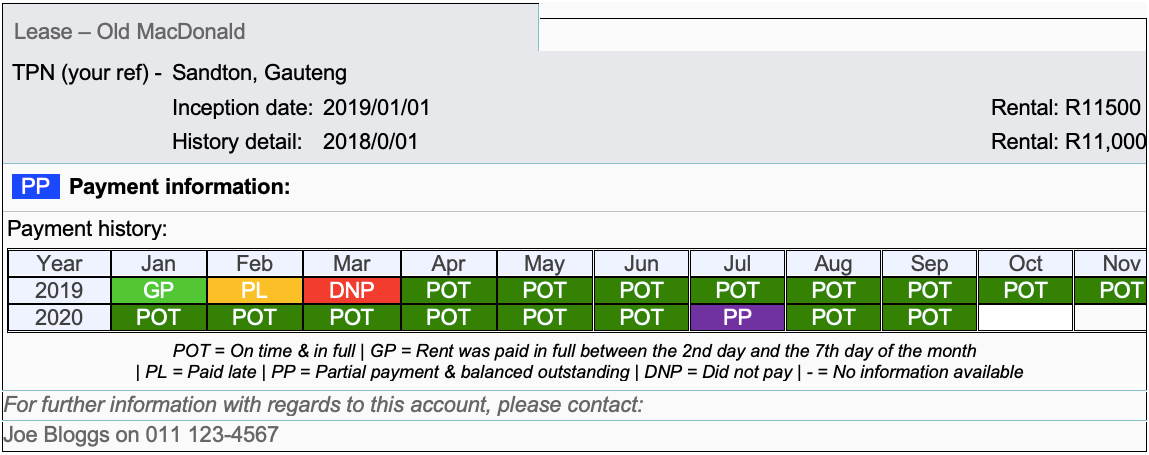

The report shows you a payment timeline indicating how the tenant has conducted his/her monthly TPN payments and credit payments, the tenant will be scored a percentage on his/her good standing. There are 3 Credex options to choose from (Basic, Silver or Gold) and these will score either an excellent, good, average, below average or poor rating. We encourage you to opt for the Gold. These rating will determine whether the tenant can afford the rental based on the inputted data. You can ascertain whether the tenant is overdebted and will fall behind on rent payments or can genuinely afford the rent. The payment timeline will indicate if there was a hiccup one month perhaps the salary was paid in late, this you can raise with the tenant. The warning flags will rate whether the tenant has a high or low risk potential to squat and this will be indicative of whether the tenant has a high risk of squatting and will most likely default on rent payments but worse you could possibly have a tenant on your hands that will not move out and could run up to a couple of months’ rent arrears leaving you out of pocket. Take heed to good advice. The date the rent payment reflects in our trust account is the date we capture payment received on TPN.

If the agent or landlord makes use of TPN and inputs the data monthly will the rental payment history be available and give you a guideline of how the tenant pays. Below is an example of what it could possibly look like.

Is it necessary to call previous landlords?

Absolutely, If the applicants physical address is correct this will show up on TPN and you can then verify the information provided but if it does not match there is a reason for concern. Remember to look at the address on the bank statements and marry that up with the TPN report. We advise that you contact the current and previous landlords and find out what the tenant was like. Ask questions such as did the tenant pay on time, what was the rental and did it include or exclude utilities, did the tenant ever default, what was the condition of the property when the tenant moved out, was the tenant evicted, did they have any pets, how many people occupied the premises? Ask when the lease expires and is there a cancellation penalty clause. Have they given notice? The alarm bells usually start ringing, the tenant signed the application giving you consent to do the reference checks but forgot to mention that he/she has not notified the landlord or the tenant is trying to do a fly by night.

Ensure that the bank statements, copies of ID’s or Passports and payslips are original and certified. There are many scammers that forge documentation.

Here is an example our one landlord used another placement agency to secure a tenant. The newbie agent was unable to spot the flaws on the payslip. By discerning and doing my own investigations I was able to prove to the owner and the agent that the company was not associated with ASATA. I suggested she question the agent contact the HR Division or accounts division which did not exist either. The name of the travel agency did not exist. The pay slip was fabricated. No company address, contact details, CK number or Co-registration number. These kinds of applicants wear many disguises. We are here to protect you, advise you and work in your best interest.

The agent provided my landlord with a basic report and said the tenant was great! I recommended that he re-do the Gold Credex score on the applicant and provide her with the references. He was not able to supply this and simply notified the landlord that she was unsuccessful.

Your investment matters to us. That’s why, at MRC Moldenhauer, we appreciate credit checks over promises of upfront rent. In the long-run, it is your financial investment that matters more than immediate gratification.